Data, the New Heavy Industry: Why Digital Infrastructure Now Requires Power Like Steel Mills

In 1712, Thomas Newcomen built the first practical steam engine to pump water from coal mines. It wasn’t until James Watt’s improvements in 1776 that steam became commercially viable, and not until the mid-19th century that steam power fuelled mass production, railways and factories. More than a century passed between the original invention and the full-scale industrial transformation.

Today, we are witnessing a parallel revolution, but at a dramatically faster pace. Instead of steam and coal, it is electrons and data. Digital infrastructure, especially for AI, has become the new “heavy industry” of developed markets. Moving electrons has replaced moving metal; cooling data centres and meeting relentless computational demand is now where efforts are focused.

At Argo Infrastructure Partners, we believe that infrastructure in the modern era must do more than withstand storms and tremors, it must endure exponential load growth and evolving technology. That is why TierPoint, our portfolio company in digital infrastructure, is not just building data centres; t is building the foundations for an AI-powered economy.

The Rising Tide of Compute: From Lines of Code to Gigawatt Demand

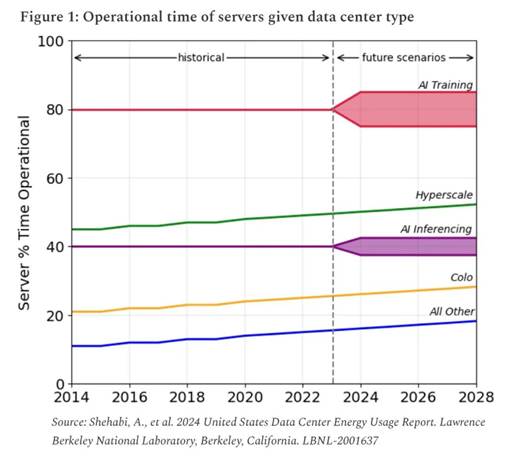

Over the past two decades, data centres have grown quietly in the background, scaling storage, virtualisation and cloud services. Their energy usage crept upward, but efficiency gains often offset increases in raw demand. Today, however, that paradigm is breaking.

AI changes the rules. Neural networks, large language models and generative systems demand orders of magnitude more compute per transaction than legacy applications. Studies suggest that an individual AI query can consume nearly ten times the energy of a standard web search. As AI becomes embedded in search engines, enterprise systems and real-time analytics, that multiplier effect compounds across billions of transactions.

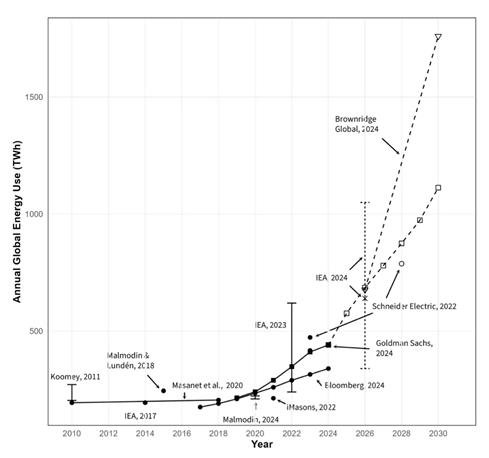

Forecasts are sobering. Goldman Sachs estimates global data centre power demand may rise 165% by 2030, relative to 2023 levels. McKinsey projects that AI and non-AI workloads could nearly triple total capacity demand by 2030, with AI workloads becoming close to 70% of the mix. The Electric Power Research Institute (EPRI) projects that US data centres might consume 4.6% to 9.1% of national generation by 2030. RAND analysis estimates global AI data centres could need nearly 70 GW of capacity by 2027, nearly double 2022 levels.

J.P. Morgan has flagged the growing friction between data centre expansion and grid constraints. Its research highlights energy supply, transmission and local grid access as primary bottlenecks in the next phase of digital infrastructure growth.

TierPoint’s Playbook: Scaling, Co-investment, Resilience

Given this backdrop, it’s not enough to build more data centres; operators must build smarter, faster and more resiliently. That is the lens through which we support TierPoint’s evolution.

Strategic scale in secondary markets: TierPoint avoids the bidding wars and grid shortages of hyperscale hubs by pursuing underserved US markets with land availability, lower energy costs and more navigable regulatory environments.

Modular expansion and partnerships: Rather than monolithic builds, TierPoint structures expansions in modular blocks, enabling staged deployment that more closely matches demand growth and capital pacing. Partnerships with utilities, renewable developers and storage providers help ensure resilient energy supply.

Resilience and redundancy: AI workloads are often mission-critical. TierPoint designs for redundancy, grid diversity and backup power solutions, including on-site generation and battery storage.

Demand forecasting and utilisation discipline: Expansion is tied to validated demand through enterprise contracts and multi-tenant leasing. This approach prevents stranded capital and ensures capacity builds are backed by customers, not speculation.

The Energy Imperative: Where Compute Meets Electrons

It is no longer tenable to view data centre investment as separate from energy infrastructure. Today, they are inseparable.

- Grid constraints already limit new development, with local utilities citing data centre demand as a driver of queue congestion and deferred upgrades.

- Efficiency gains will help, but cannot keep pace with exponential AI demand growth.

- Renewable energy, battery storage, and eventually, dispatchable sources such as small modular nuclear must be part of the mix.

- Regulated utilities are partners in this transition, not rivals, and collaboration on grid upgrades will be critical.

In short, data centres are no longer passive electricity consumers. They are active participants in the energy ecosystem, and the operators that master both compute and power will lead.

Conclusion

AI-driven demand is rewriting the rulebook for digital infrastructure. Compute is becoming as capital-intensive, energy-sensitive and regionally constrained as traditional heavy industry.

TierPoint’s mindset of disciplined expansion and energy partnerships embodies how we believe tomorrow’s digital infrastructure will be built. In a world racing toward 100 GW of demand, operators who integrate power, purpose and performance will be the winners.

For more on Argo’s infrastructure investment strategy, visit argoip.com.